How Withdrawal Rates Impact Your Portfolio in Retirement

Many people spend years preparing for retirement by saving and investing, but planning shouldn’t stop once the paychecks do. Transitioning from earning income to withdrawing it from your portfolio is a major shift with a new set of risks and decisions. This period, known as the distribution phase, requires careful thought. How much you withdraw each year can have a bigger impact on long-term financial security than many people realize. Without a well-structured strategy, even a sizable retirement account can be depleted faster than expected.

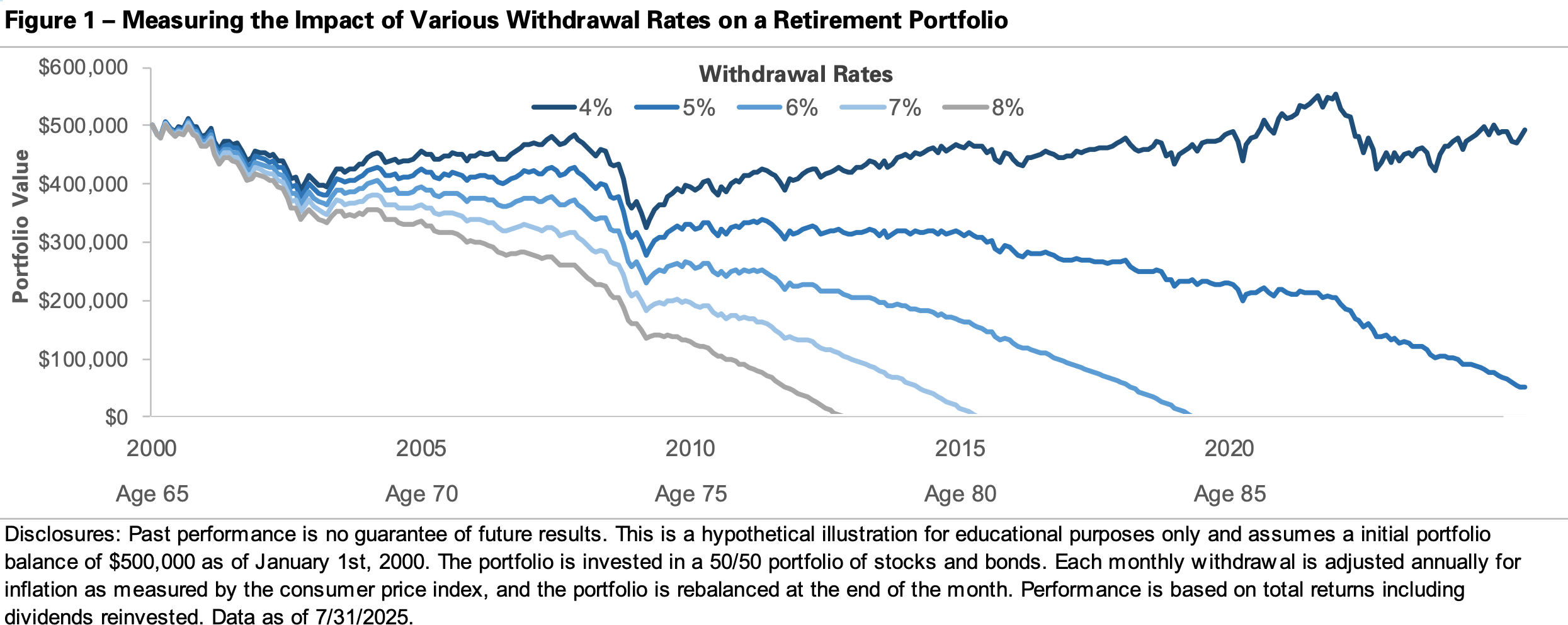

The chart below shows how different withdrawal rates can impact a retirement portfolio’s lifespan. It assumes an individual retired in 2000 at age 65 with $500,000 and started taking monthly withdrawals. Each line reflects a different withdrawal rate between 4% and 8%, showing how the portfolio fared through age 85. While all scenarios start at the same point, the paths quickly diverge, especially during periods of market volatility. The chart illustrates how a retiree’s withdrawal strategy can determine whether the portfolio lasts or runs out.

The message is clear: higher withdrawal rates tend to exhaust a portfolio sooner, while lower rates can extend its life. In this example, withdrawing 7% or 8% caused the portfolio to run out of money before age 85. In contrast, the 4% and 5% withdrawal rates helped the portfolio weather market declines. The 4% strategy not only preserved the portfolio but grew it over 20 years, showing how compounding can work even during retirement. No strategy can eliminate market risk, but a smaller withdrawal rate can extend the portfolio’s life and reduce the risk of outliving your savings. Taking a more conservative approach in the early years of retirement gives your portfolio time to recover from short-term losses and grow with the market.

A thoughtful withdrawal strategy is an important part of retirement planning. It’s not just about how much you’ve accumulated, but how you manage it. There’s no one-size-fits-all approach, and the method you start with doesn’t have to be permanent. Fixed withdrawal rates can provide a good starting point, but many retirees may benefit from more flexible approaches. For example, you could adjust withdrawals based on market conditions, taking smaller distributions in down years and larger ones in strong years. Another option is the bucket strategy, which divides assets into short-, intermediate-, and long-term segments. By keeping a few years’ worth of expenses in cash or short-term investments, you can avoid selling stocks during major market declines, such as those in 2008 or 2020. This gives long-term investments time to recover and can help create a steadier income stream over time. Everyone’s retirement looks different. Our goal is to help you create a withdrawal strategy tailored to your unique needs and goals when that time comes.

Important Disclosures

Published by Market Desk Research and distributed by QuadCap Wealth Management, LLC.

This client letter is being furnished by QuadCap Wealth Management, LLC (“QuadCap”) on a confidential basis for the exclusive use of clients of QuadCap. and may not be disseminated, communicated, reproduced, redistributed or otherwise disclosed by the recipient to any other person without the prior written consent of QuadCap.

This document does not constitute an offer, solicitation or recommendation to sell or an offer to buy any securities, investment products or investment advisory services. Such an offer may only be made to prospective investors by means of delivery of an investment advisory agreement, subscription agreement and other similar materials that contain a description of the material terms relating to such investment, investment strategy or service. This presentation is being provided for general informational purposes only.

This presentation includes information based on data found in independent industry publications and other sources and is current as of the date of this presentation. Although we believe that the data are reliable, we have not sought, nor have we received, permission from any third-party to include their information in this presentation. Charts, tables and graphs contained in this document are not intended to be used to assist the reader in determining which securities to buy or sell or when to buy or sell securities. Opinions, estimates, and projections constitute the current judgment of QuadCap and are subject to change without notice.

References to any indices are for informational and general comparative purposes only. There are significant differences between such indices and the investment programs described in this presentation. References to indices do not suggest that the investment programs will, or are likely to, achieve returns, volatility, or other results similar to such indices. The performance data of various indices presented herein was current as of the date of the presentation.

Past performance is not indicative of future results and there can be no assurance that the future performance of any specific investment or investment strategy will be profitable or equal any corresponding index or benchmark. The performance information shown herein is based on total returns with dividends reinvested and does not reflect the deduction of advisory and/or other fees normally incurred in the management of a portfolio.

Advisory Services are offered through QuadCap, an SEC registered investment advisor. QuadCap only transacts business in states where it is properly registered or is excluded or exempted from registration requirements. SEC registration is not an endorsement of the firm by the Commission and does not mean that QuadCap has attained a specific level of skill or ability.